694

views

views

Bitcoin, which has increasingly been referred to as "digital gold," flipped silver's market capitalization on its way past $71,000 and setting a new all-time high.

It's a milestone that Bitcoin has seen often since the beginning of March.

On Friday afternoon, Bitcoin broke above $70,000 for the first time ever. Then early Monday morning, the Bitcoin price began climbing and was $71,239.37 at the time of writing. It's gained 2.7% since yesterday and 11.4% since this time last week.

As is usually the case, the all-time high price depends on which exchange or price aggregator you check. At approximately 9:20 Central European Time the BTC price was $71,700 on Coinbase; $71,560 on CoinGecko; and $71,607 on CoinMarketCap.

It was only just three months ago, when anticipation for the approval of spot Bitcoin ETFs started to build that Bitcoin managed to flip Elon Musk's electric vehicle company Tesla, Facebook, Instagram, and WhatsApp parent company Meta, and acclaimed Bitcoin hater Warren Buffett's multinational conglomerate Berkshire Hathaway.

The late Berkshire Hathaway Vice Chairman Charlie Munger called it “rat poison”; the company’s CEO, Warren Buffett, called it “rat poison squared.” Both agreed it was “worthless.” Now, it’s bigger than both of them—and some of Wall Street’s other favorite companies. Off a weeks-long sprint of consistent gains, Bitcoin is now more valuable than financial behemoth Berkshire Hathaway, tech giant Meta, and electric car company Tesla, according to market capitalization data from CoinGecko. At writin.

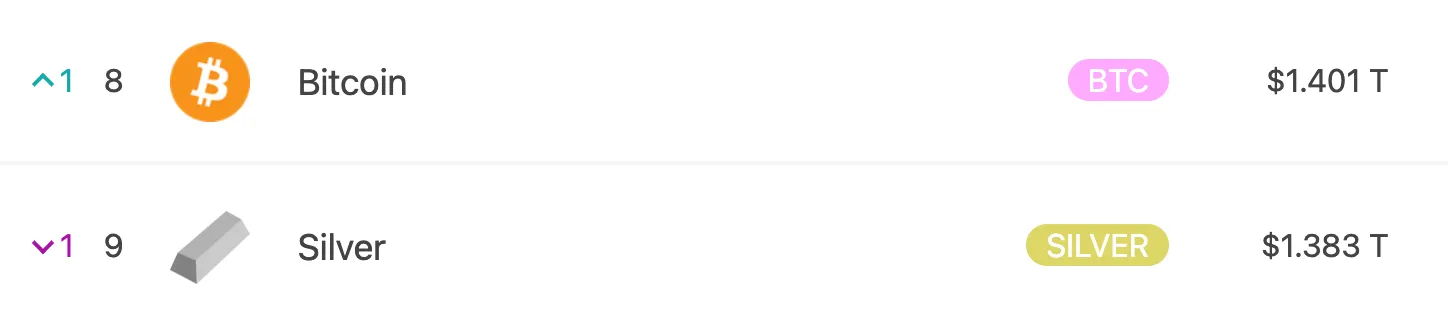

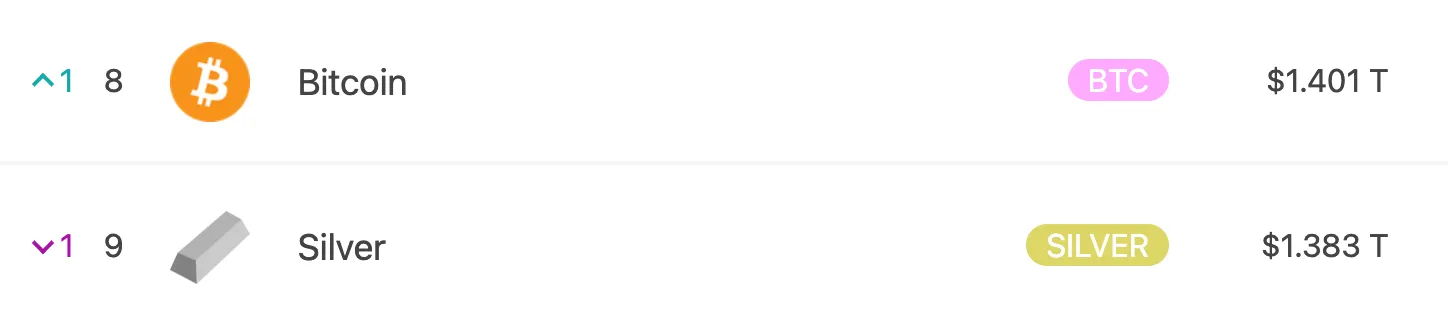

That makes Bitcoin the newly minted eighth-largest by virtue of its $1.4 trillion market cap. Besides gold, which has long held the top spot with its $14.7 trillion market cap, it's still trailing behind Microsoft, Apple, Nvidia, Saudi Aramco, Amazon, and Google parent company Alphabet.

Why the bullish price rally? One big reason is the approaching Bitcoin halving. The latest estimate is that the halving will occur in approximately 35 days, on April 15, according to NiceHash.

The Bitcoin halving reduces the reward paid to Bitcoin miners for process new blocks on the network. It's happened three times already since Bitcoin originated. This fourth halving will see the Bitcoin reward reduced from 6.25 BTC to 2.125 BTC.

Comments

0 comment